- #Where is my quickbooks payroll service key how to

- #Where is my quickbooks payroll service key full

- #Where is my quickbooks payroll service key professional

- #Where is my quickbooks payroll service key zip

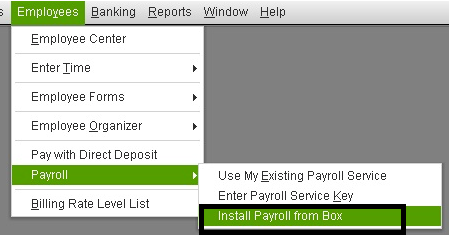

Call our QuickBooks experts at our toll-free number if you wonder about “Where to add QuickBooks EIN” and related questions like this. This conveys us to the destiny of this blog. Select View to display the new service key with an Active Status.ĥ This conveys us to the destiny of this blog Choose Employees, and then choose My Payroll Service, then select Manage Service Keys. 8.Important Note: The Validating Payroll Subscription window opens, and the service is added automatically. 7.You can select to Print or Return to QB Desktop. 6.Select Next to add the company EIN When the Add Company Information window opens.

#Where is my quickbooks payroll service key zip

4.In case you don't find your own subscription in the list, choose Other: I have an existing subscription and a Zip Code. 3.Choose Use Subscription Number XXXXXXX Under Identify Subscription.

#Where is my quickbooks payroll service key how to

In case you pay your employees with Direct Deposit (DD), you can have multiple companies (separate data files with different EINs) with DD on the same DIY Payroll subscription.Ĥ How To Count an EIN to Current QuickBooks Desktop Payroll?ġ.Choose Employees, then choose Payroll. Contact information and payroll admin for the payroll subscription will be the same for all the companies you add to a single subscription. If you choice attempt to use multiple business files under the exact Employment Identification Number and the exact payroll subscription, may generate an issue. QB Desktop Payroll only supports one company data file per Employment Identification Number. You have to use the same registered copy of QB Desktop, on the same machine, for processing payroll for each company on a single payroll subscription. The main purpose of this number is identification. It is an unique nine-digit number assigned to business entities by the Internal Revenue Service (IRS) in the United States. However, if you get stuck anywhere while adding EIN to QuickBooks Payroll, call our highly experienced QuickBooks experts at ourĮIN stands for Employer Identification Number, which is occasionally called Federal Employer Identification Number, shortened as FEIN.

#Where is my quickbooks payroll service key full

So, we suggest you to give full attention to the blog so that you can do it by yourself. In this blog, we resolve to try to provide you with the best way for adding EIN to the QB payroll.

Enter a name for the service into the Item Name/Number box. In the New Item window, select Service from the Type drop-down. Then select the New command from the pop-up menu. Adding EIN is important for any QuickBooks users. To create service items in QuickBooks Desktop Pro, click the Item button in the lower-left corner of the list window.

We will look at the most appropriate method in this blog. There are various methods available to add an EIN to existing Payroll Subscription. Users can add EIN to their Payroll you can even add an EIN to your current QuickBooks Desktop Payroll account. QuickBooks allow you to send payroll reports to your employee and accountant. Published and marketed by Intuit, QuickBooks contains furnished users with multiple outstanding features. We aim to enhance customer satisfaction and deliver our promised service value through the effective application of system and process assurance and full compliance - and we’ve been rigorously assessed by various regulatory bodies to ensure this is the case.Presentation on theme: "Here Is the Way to Add EIN To QuickBooks Payroll"- Presentation transcript:ġ Here Is the Way to Add EIN To QuickBooks Payroll When it comes to outsourcing payroll, you want to be confident that your provider’s system, process and technology platform will work effectively. Our specialist charity payroll services cover a range of not-for-profit organisations or social enterprises - accurately, confidentially and compliantly tackling all payroll matters through a simple, cost-effective and tailored solution. We have years of experience working with accounting firms to deliver their entire client payroll operation. We also offer specialist UK payroll services for accountants and charities.Īccounting firms will often require a back-office white-label solution to ensure their clients’ payroll processing is entirely compliant with all legal reporting requirements.

#Where is my quickbooks payroll service key professional

Our customer base spans a broad range of industries, including hospitality, construction, security, retail, charity, legal, accountancy/finance, technology and professional services. Over the years, we’ve worked with a range of clients in both the private and public sectors. As well as local UK taxation rules and labour laws, many industries have specific payroll requirements that must be considered.

0 kommentar(er)

0 kommentar(er)